A Land Of Plenty: Job Vacancies Across Regional Australia Remain At Record Levels, Still Outpacing Workforce And Population Growth

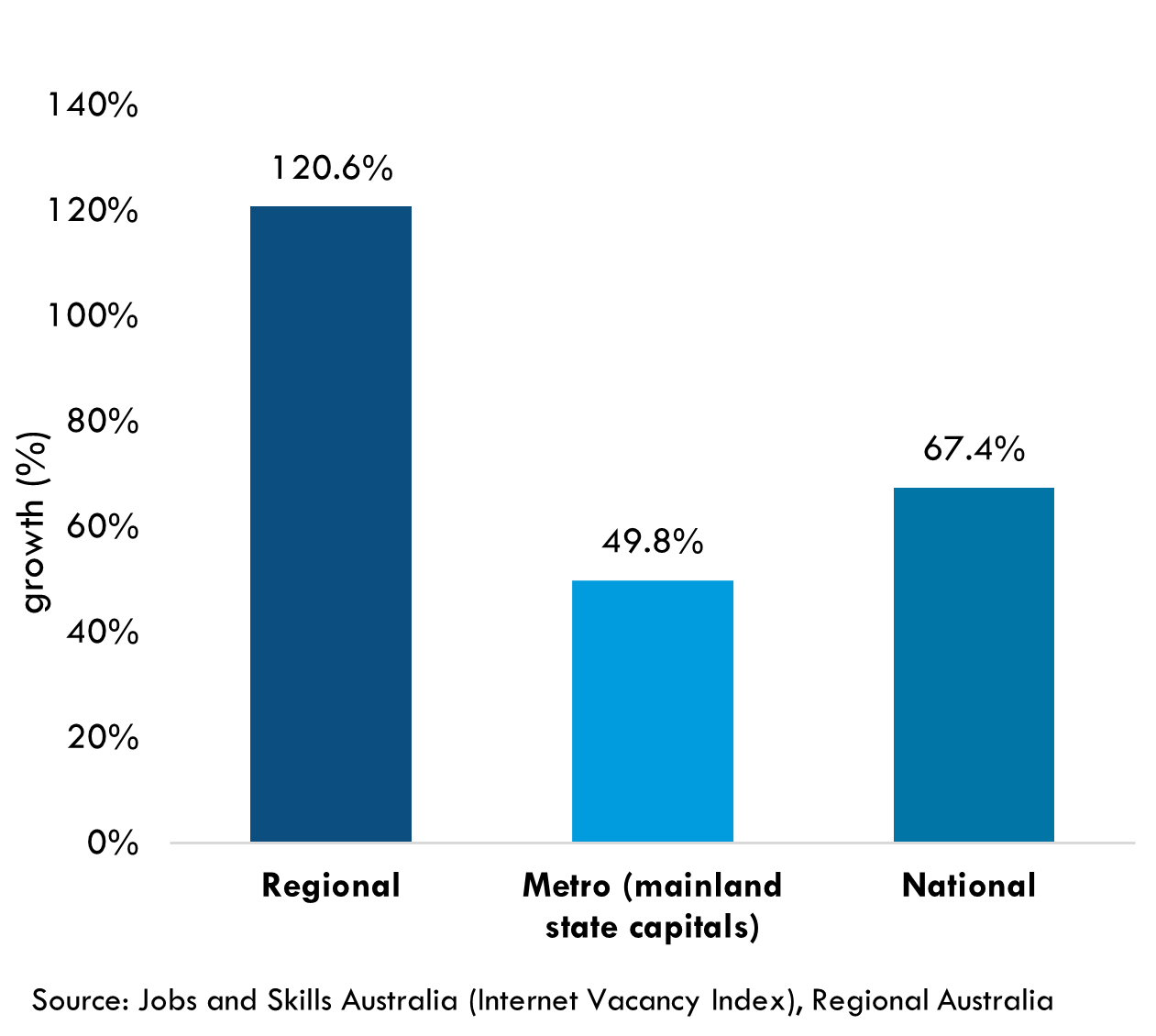

Whilst the regional Australian labour supply is at a record level - just below five million persons employed - regional labour demand is also at near record highs and not falling as it is in metro Australia. The chart on the right shows the extent of labour demand in regions post COVID, with job vacancy growth double that of metro areas. These high vacancy levels persist in regional Australia despite strong workforce growth – it is simply not growing fast enough to reduce the number of unfilled vacancies.

The regional unemployment rate rose slightly in the September quarter alongside a drop in the participation rate. On the surface this suggests a weakening of conditions: an increase in the number of people looking for work, and people removing themselves from the labour force. However, employment figures are still seeing tremendous growth with the number of people working in our regions just shy of five million. The Construction, Wholesale Trade, Accommodation and Food Services, and Professional Services industries collectively added 115,000 jobs to our regions over the last year, indicating a booming and diverse regional economy.

Conditions remain incredibly tight in many of regions, with seven regions having an unemployment rate below 2%. Likewise, every single state and territory of Australia experienced positive employment growth over the last year; but this growth is constrained by workforce availability.

It remains an employee’s job market with hiring conditions tough for employers. The September figures revealed 91,400 job vacancies across regional Australia – just shy of the record 94,000 in September 2022. The shortages were most pronounced in professional positions, with managerial and trade-based occupations also in high demand.

Unfortunately, the tight labour market has failed to translate into significant wage increases and conditions are tough for many households. The latest inflation figures show a 5.4% annual rise with the Wage Price Index showing just a 3.6% annual rise. Future rate rises remain on the cards (although hopefully not), with some of the major banks tipping another rate rise on the horizon. The Reserve Bank of Australia also forecast the unemployment rate to increase to 4.5% by December 2025. All of this suggests more pain for households over the coming years.

As seen in the metro vs regional job vacancies chart above, there are a large number of job opportunities throughout regional Australia. This, combined with cheaper house prices, allows regional Australia to retain its position as an attractive destination relative to our metropolitan centres.

|

Monthly job vacancies compared to pre-COVID average

|

Regional and metro Australia unemployment rates |

|

|

The Regional Labour Force Continues To Grow

|

Regional Australia labour force - size

|

Regional Australia labour force - annual growth |

|

|

Regional Australia’s labour force (those employed plus those looking for work) reached 5.13 million people in September 2023, adding 3.3% on last year. At 3.3%, the regional labour force grew faster than its metropolitan counterpart, which experienced growth of 2.6% over the same period.

There are a record number of people working in our regions: over the past year an average of 13,800 people have joined the labour force every month.

Regional Participation Has Pulled Back Slightly

In May 2023, the regional participation rate reached its highest ever level of 64.54%. Over the last few months there has been a sharp decline back to 63.65% this September. Similarly, the metropolitan participation rate also experienced a relatively large drop this quarter.

The gap of 4-5 percentage points between the metropolitan and regional rates remains relatively stable, with the regional rate at 63.65% and the metropolitan rate at 68.09% as of the September quarter.

Regional Australia Participation Rate Source: ABS Labour Force (detailed), RAI

Unemployment Remains Low

From a pandemic high of 7.0% in June 2020, the regional unemployment rate experienced a record-breaking drop to a low of 2.8% in November 2022. This appears to have been the limit of how low the unemployment rate could go in Australia. Since them, the regional unemployment rate has hovered around 3.4% for most of 2023.

As of September 2023, the unemployment rate sits at 3.3%, just slightly lower than its yearly average. As throughout much of the post-pandemic period, this is lower than the metropolitan average, which currently sits at 3.5%.

Regional Australia Participation Rate Source: ABS Labour Force (detailed), RAI

Source: ABS Labour Force (detailed) RAI

Regional and metro Australia unemployment rates

Source: ABS Labour Force (detailed) RAI

This reduction in the unemployment rate throughout 2022 and subsequent pause for much of 2023 has moved in tandem with the internet vacancy index, which has also held steady for much of 2023.

Recent forecasts from the Reserve Bank of Australia suggest that the unemployment has indeed reached its lowest point and will climb to 4.5% by December 2025. Note however this is still relatively tight by historical standards.

Internet Vacancy Index

Regional Job Vacancies Steady At 91,400 In September

Regional job vacancies held steady at 91,400 in September 2023, marking a modest 0.5 per cent increase from August 2022. The resilience of the regional job market stands in contrast to metropolitan Australia, where job vacancies experienced a 0.6 per cent dip over the past month and a significant 10.8 per cent downtrend year-on-year.

Regional Australia job vacancies

Source: Jobs and Skills Australia, monthly internet vacancies, RAI

The Northern Territory, regional New South Wales, and regional Queensland had the highest rates of vacancy growth from August to September. The top growth regions were scattered around Queensland, New South Wales, Western Australia, and the Northern Territory.

The annual change in job vacancies across all regions varied significantly, ranging from a substantial increase of 22.5 per cent in Regional Northern Territory to a decrease of 12.7 per cent in Gosford and the Central Coast. In comparison, Sydney and Melbourne, the nation’s largest cities, observed the steepest annual declines at 15.1 per cent and 14.4 per cent respectively.

The five regions that recorded the largest monthly increases in vacancies in September 2023 were:

• Sunshine Coast up by 4.0% (3,769 compared to 3,626)

• Southern Highlands & Snowy up by 3.7% (1,451 compared to 1,399)

• Gosford & Central Coast up by 3.1% (2,085 compared to 2,021)

• Regional Northern Territory up by 3.1% (1,110 compared to 1,077)

• Pilbara & Kimberley up by 2.9% (2,489 compared to 2,419)

The five regions with the biggest jumps in vacancies in September 2023 compared with September 2022 were:

• Regional Northern Territory up by 22.5%

• Central Queensland up by 16.4%

• Wimmera & Western up by 11.7%

• Southern Highlands & Snowy up by 9.5%

• Darwin up by 8.5%

In terms of the occupations being demanded, vacancies are largest for Professional roles (29%), followed by Technicians and Trades roles (15%), and Community and Personal Service roles (13%).

Regional Labour Markets And Industry Employment

Employment Growth Remains Very Strong – With All States And Territories Seeing Growth In Employment

At the state level, annual employment remained very strong – with every state and territory experiencing employment growth. The range of growth however was quite large, with regional South Australia experiencing growth of 11.8%, whilst the Northern Territory saw growth of only a 0.6%.

Quarterly growth was a different story. Compared to the June quarter only one state, regional South Australia, experienced employment growth. All other states and territories experienced declines, with the Northern Territory again seeing the largest decline in employment of 4.9%.

When zooming further down to the SA4 level we again see a significant gap. There are currently seven regions with unemployment below 2% (all of which are on the east coast). Regions such the NSW Central West, Darling Downs and Shepparton have essentially zero unemployment. In contrast, the central and western regions of Australia averaged 4.6%. The Queensland Outback remains the highest by far, with an unemployment rate of 13.2%. Coffs Harbour (6.5%), the Northern Territory Outback (5.9%) and Wide Bay in Queensland (5.7%) had the next three highest unemployment rates.

The following table shows the five regions of Australia with the largest annual falls in their unemployment rates. You’ll notice that Shepparton and the Far West and Orana have 0% unemployment. Whist the Australian Bureau of Statistics acknowledges that reliability is an issue with smaller regions, there is no doubt that unemployment in these regions is extremely low. It’s also worth noting that all five regions with the largest drops in unemployment are on the east coast.

Many of the regions whose unemployment rate increased already had high unemployment rates to begin with – such as the Queensland Outback. The data clearly shows the widening gap between many of our regions.

Five SA4 regions with the largest annual fall in unemployment rates

Source: ABS Labour Force (detailed), National Skills Commission, Regional Australia Institute

Regional Employment By Industry – Levels And Growth

Regional employment took a slight backstep this quarter on its way to reaching 5 million people. It currently sits at 4.95m people in September, down by 32,000 people from its height of 4.98m in May. With any luck regional employment should reach 5 million people by Christmas, or possibly shortly afterward. Annual growth figures remained impressive, with the regions adding 4.1% more jobs than last year.

Collectively, the Construction (28,000), Wholesale Trade (21,000), Accommodation and Food Services (40,000) and Professional Services (26,000) added 115,000 jobs to our regions over the last year, indicating a booming and diverse job market.

In terms of percentage growth, Wholesale Trade (20%), Financial Services (16%) and Accommodation and Food Services (13%) all experienced strong annual growth. Accommodation and Food Services has surpassed its peak employment numbers prior to the COVID shutdowns. This is no surprise given the strong return of international visitors as well as continued interest in domestic tourism from cities to our regions. But this growth is restrained by workforce availability. RAI analysis shows that occupations in the tourism and hospitality industries represent the largest number of advertisements in the internet vacancy index. Employers are crying out for chefs, hotel managers, café workers, waiters, and all things hospitality related. Apparently, the secret is out that region Australia is a nice place to visit.

|

Regional employment by industry Aug qtr 2023 (000s)

|

Regional employment by industry annual change, Aug qtr 2023 (%) |

|

|